Services available: Questions? Work directly with a Flood Map Specialist.

Understanding Flood Zones:

- Zone A:

- Description: This area is subject to inundation by the 1-percent annual chance flood (commonly referred to as the “100-year flood”). Flooding in Zone A is usually determined using approximate methodologies.

- Implications: Properties in Zone A are typically required to have flood insurance, as they face a significant risk of flooding.

- Zone X:

- Description: Zone X is classified as an area of minimal or moderate flood risk. This zone is typically outside the 1-percent annual chance floodplain.

- Implications: While flood insurance is not mandatory for properties in Zone X, homeowners are still encouraged to consider coverage, as flooding can occur even in low-risk areas.

Other Common Zones:

- Zone V: Areas at risk of coastal flooding with additional hazards, like wave action.

- Zone AE: Similar to Zone A, but with base flood elevations provided.

Why This Matters: Understanding your property’s flood zone is crucial for assessing flood risk and making informed decisions about flood insurance and preparedness. The FIRM is a vital resource for homeowners, ensuring they are aware of their flood risk and can take appropriate action.

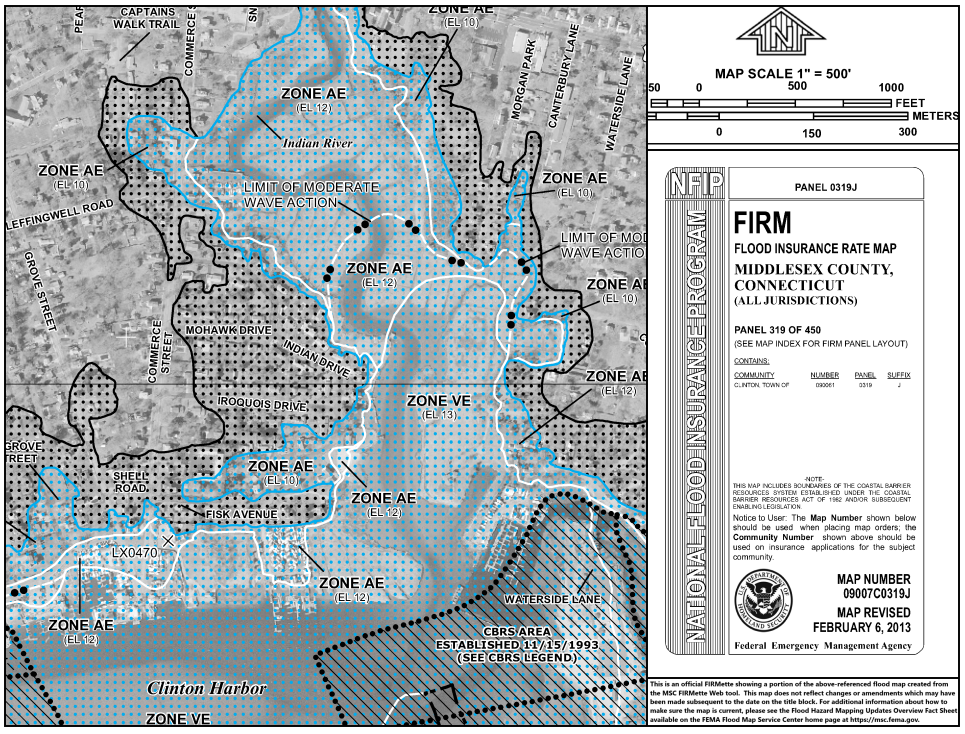

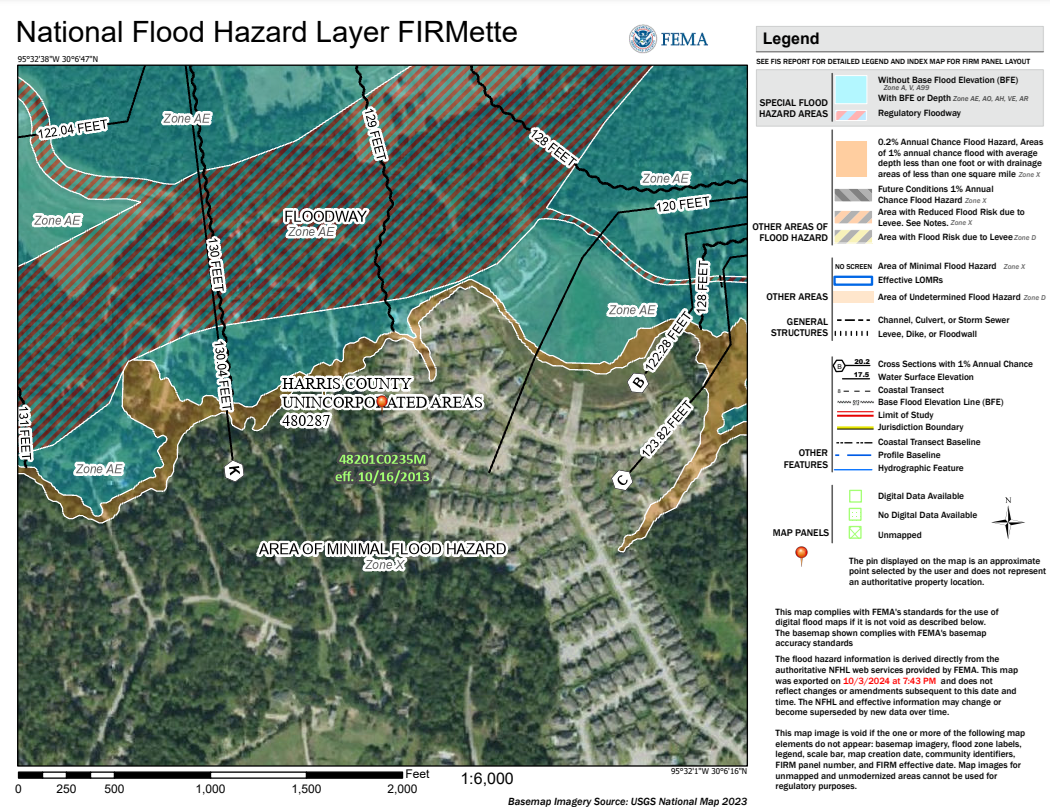

FEMA Flood Insurance Rate Map (FIRMette)

The FEMA Flood Insurance Rate Map (FIRM) is an essential tool that delineates flood hazard areas in your community.

It helps homeowners understand their flood risk and determine whether flood insurance is necessary. The map categorizes properties into different flood zones, each indicating a varying level of flood risk.

Enter address to research:

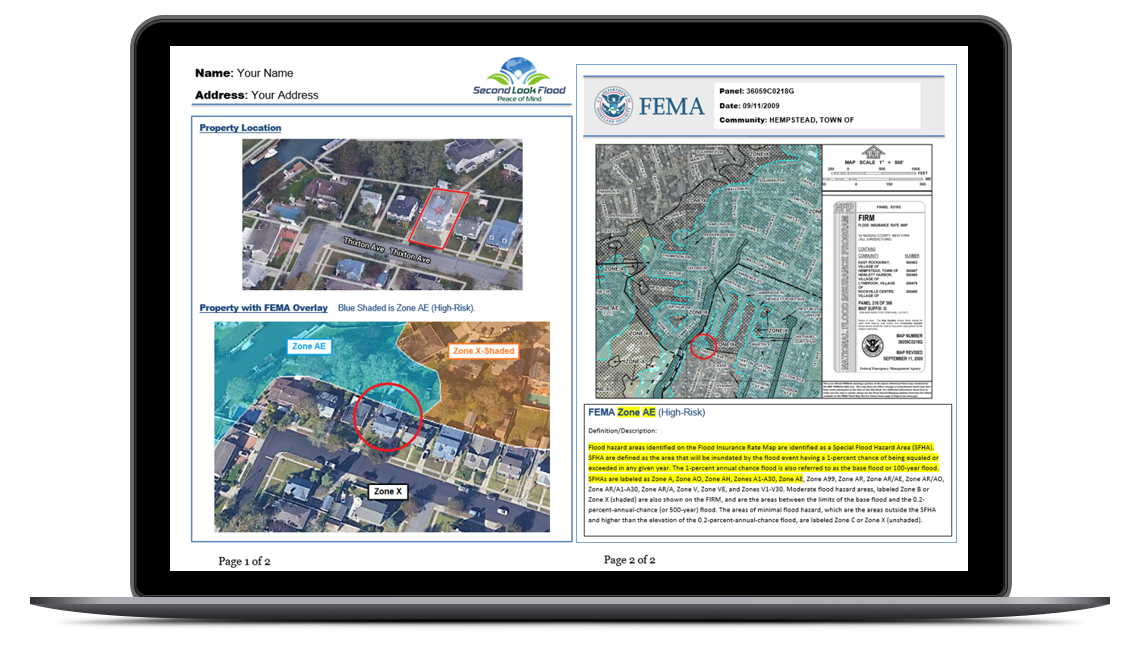

FEMA Flood Zone Review

Need verification for your lender or insurance company?

Our Custom Flood Zone Report provides a comprehensive overview of your property’s flood risk, combining detailed mapping with expert analysis.

This report features an overlay of the FEMA Flood Insurance Rate Map (FIRM) onto a visual representation of your property, allowing you to easily identify its designated flood zone.

Enter address to research:

Key Benefits of Review:

Visual Clarity: The overlay visually illustrates your property’s location in relation to flood zones, making it easy to understand potential risks.

Verification: This flood zone report serves as a reliable verification tool, supporting the FEMA Standard Flood Hazard Determination Form. It confirms the flood zone classification and ensures accurate information for homeowners and lenders.

Enhanced Decision-Making: With clear insights into flood risks, homeowners can make informed decisions regarding insurance, property improvements, and emergency planning.

Peace of Mind: Knowing the specifics of your property’s flood zone empowers you to take proactive measures to protect your home and investments.

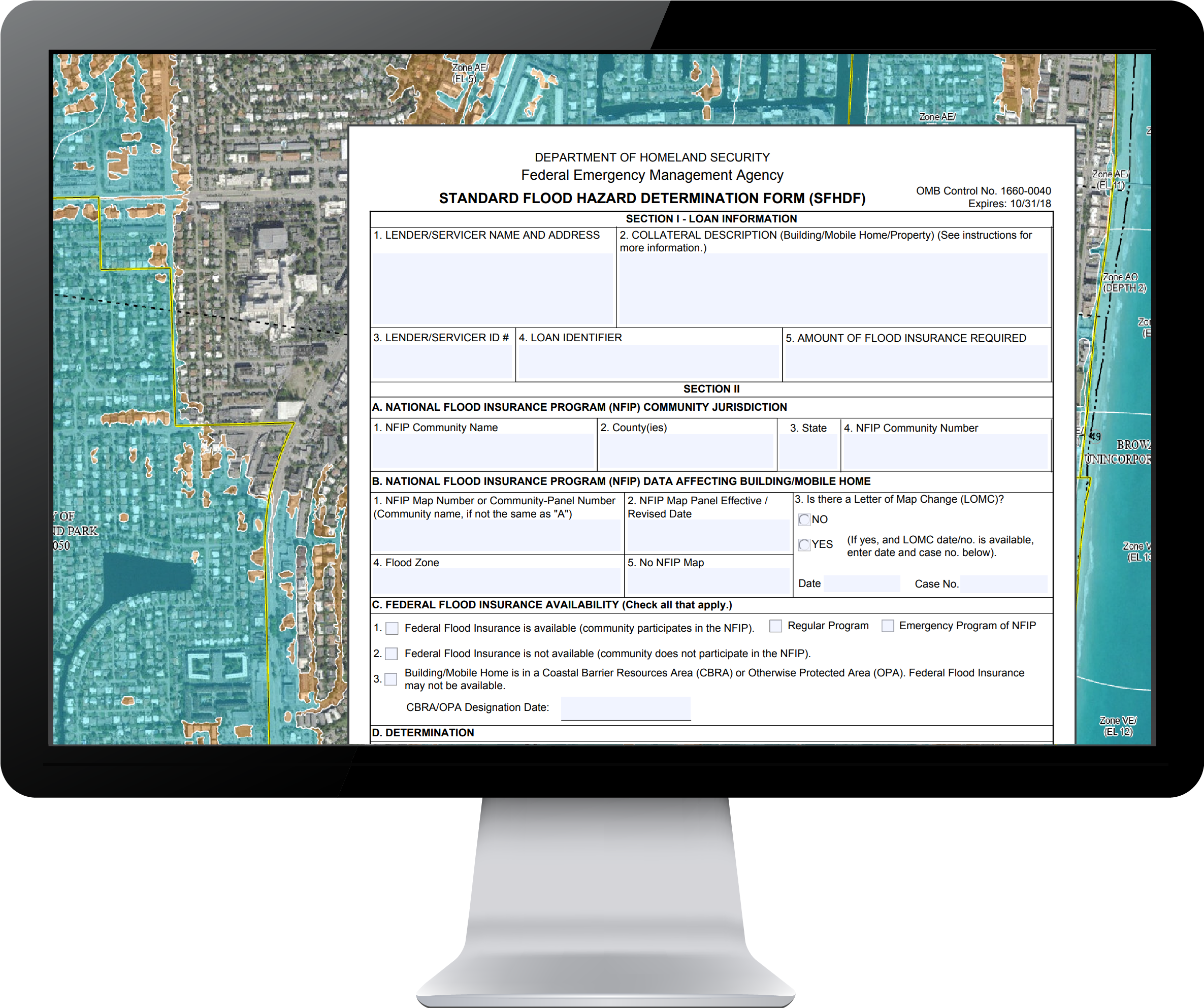

Flood Zone Determination Form

The FEMA Standard Flood Hazard Determination Form (SFHDF) is an important document that assesses the flood risk of a property.

This form is used by lenders to decide if flood insurance is required, and can also be used by insurance agents, property owners, realtors, and local officials for flood insurance and flood zone verification.

With our help, you can run your own Determination Form to dispute a lender or insuance agent.

Enter address to research:

Why Homeowners Need a FEMA Determination Form:

Insurance Requirements: Many lenders require the SFHDF to determine whether flood insurance is necessary for mortgage approval. Understanding flood risk can protect you from potential financial loss.

Informed Decision-Making: Knowing your property’s flood zone can help you make informed decisions about home improvements, insurance, and emergency preparedness.

Regulatory Compliance: Homeowners are often required to provide this form when selling their property or making significant renovations, ensuring compliance with local regulations.

Peace of Mind: Being aware of flood risks helps you take proactive measures to safeguard your home and assets.

Work with a Flood Map specialist

Delivered by email (Under 24-hours)

FEMA Flood Zone Review

This comprehensive report helps homeowners & buyers assess risk and make informed decisions on property purchases or insurance coverage.

Flood Hazard Determination Form

This FEMA document is used by Federally regulated lending institutions when determining whether flood insurance is required and available.

FEMA Flood Insurance Rate Map

The Official FEMA Flood Insurance Rate Map (FIRM). Visual proof of the Flood Zone to support the Determination Form.

Enter address to research:

Testimonials

What People are Saying

“Very Accurate”

"Many thanks for your quick research ... and very accurate! Will recommend you to all my clients!"

Belinda in Louisiana

“Professional and Prompt”

“Wow…thank you so much – how professional and prompt – what a pleasant change from the norm!“

Laura in Conneticutt

“Beyond my expectations”

"I am truly amazed with this report! The detail you have given me are above and beyond my expectations."

Deb in West Virginia

"Great Job"

"You did a great job. I would be happy to recommend you to any consumer. You were efficient, professional and honest. Again, great job."

Miriam in Florida